PCI DSS Compliance Checklist 2024

If your organization handles card data through online portals or POS (Point of Sale) devices, it must adhere to PCI DSS (Payment Card Industry Data Security Standards) to avoid penalties and damage to its reputation. However, achieving PCI DSS compliance is a complex, time-consuming, and costly process.

This article aims to simplify this process by explaining the PCI compliance framework, outlining the different levels of compliance, briefly discussing the 12 PCI DSS requirements, and providing steps to achieve PCI DSS compliance

Overview of PCI DSS compliance

PCI DSS (Payment Card Industry Data Security Standard) compliance consists of security standards established by credit card companies to ensure that businesses processing, transmitting, or storing credit card information do so securely.

The primary goal of PCI DSS compliance standards is to prevent data breaches and safeguard sensitive cardholder information.

In 2004, the founding members of PCI DSS, including VISA, MasterCard, JCB International, and Discover Financial Services, collaborated to create a regulatory framework aimed at protecting user credit card data from fraudulent activities.

Why was PCI DSS implemented?

The PCI DSS compliance framework was put in place to enable organizations processing electronic transactions to implement necessary processes and policies to maintain a strong security posture and protect cardholder data.

The latest version, PCI DSS version 4, introduced in March 2022, brought reforms to existing security rules, making the framework more flexible and user-friendly. It can be easily implemented with the help of the PCI DSS compliance checklist.

PCI DSS Compliance Levels

To better understand the PCI DSS compliance checklist, it’s important to determine the level at which your business operates. This assessment will help you evaluate the PCI requirements.

Level 1: Processes over 6 million transactions annually, and any organization identified as Level 1 by VISA must implement Level 1 grade controls.

Level 2: Requires Level 2 security for 1 to 6 million yearly transactions.

Level 3: Handles 20,000 to 1 million online transactions yearly. Needs Level 3 security measures.

Level 4: Processes up to 20,000 e-commerce transactions a year and handles up to 1 million total transactions a year. Implementation of controls and policies at Level 4 is mandatory.

| PCI Compliance Level | Annual Transactions |

| Level 1 (High Difficulty) | Over 6 million |

| Level 2 (High Difficulty) | 1 – 6 million |

| Level 3 (Moderate Difficulty) | 20,000 – 1 million |

| Level 4 (Low Difficulty) | English |

PCI DSS compliance checklist: Objectives and Requirement

Depending on the PCI DSS requirements of your organization, the complexity of managing your PCI DSS compliance journey will differ.

Organizations need to implement controls, security policies, and administrative processes to protect card data and achieve PCI DSS compliance.

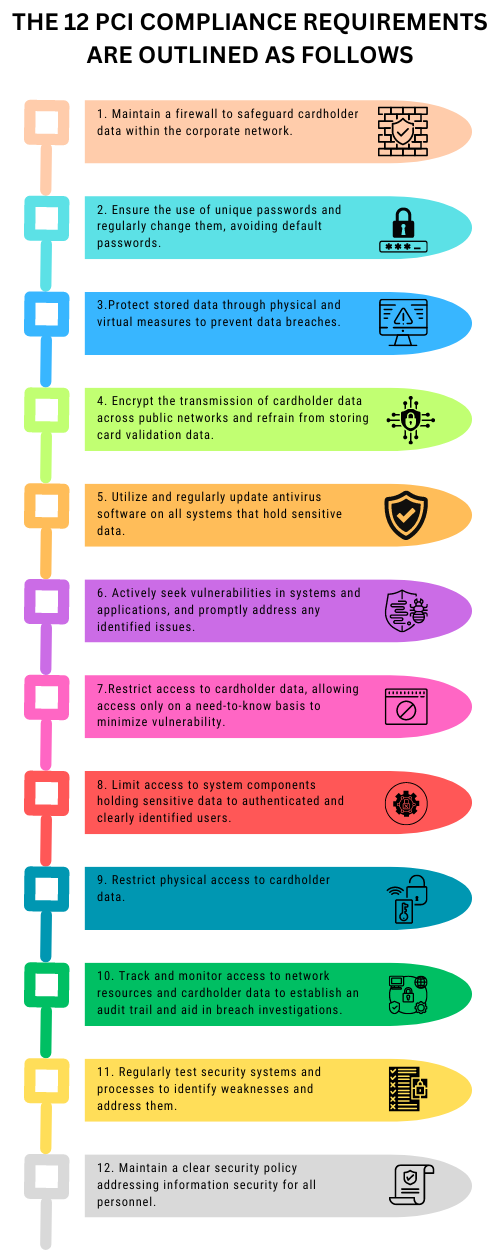

Here is the PCI DSS Compliance Checklist for 2024:

Here’s a bullet-pointed PCI DSS Compliance Checklist for 2024:

1. Install and Maintain a Firewall:

- Protect security systems from unauthorized traffic.

- Filter and permit only authorized traffic.

- Secure POS devices on wireless networks.

- Control outbound traffic from card storage areas.

- Log all changes with justifications.

2. Avoid Default Vendor Settings and Passwords:

- Change default usernames and passwords.

- Configure settings for security, not convenience.

- Use strong passwords.

3. Protect Cardholder Data:

- Safeguard all cardholder information.

- Understand data flow within the organization.

- Store, access, transmit, and dispose of data securely.

- Mask PAN to show only the last few digits.

4. Encrypt Transmission:

- Use encryption for card data during transmission.

- Protect data on all channels, including the internet.

Automate all the PCI DSS requirements with the help of Vivant. Talk to our experts

Book a 1:1 Demo

5. Use Updated Antivirus Software:

- Keep antivirus software up-to-date.

- Install advanced solutions on all devices with network access.

- Ensure continuous operation and log scanning.

6. Keep IT systems and software secure and up-to-date:

- Conduct internal risk assessments.

- Identify and patch vulnerable areas.

- Apply continuous patches and remediation measures.

Remember, managing PCI DSS compliance depends on your organization’s specific requirements and the complexity of your systems. Regularly reviewing and updating these practices is crucial for maintaining compliance and protecting sensitive data.

7. Limit Access to Cardholder Data:

- Control employee access based on need, seniority, or role.

- Document access control procedures.

8. Unique User IDs:

- Assign unique IDs to employees for security and tracking.

9. Control Physical Access:

- Restrict access to physical data assets.

- Use RFIDs and surveillance to secure data.

10. Monitor Network Access:

- Secure network resources against unauthorized access.

- Log and review network activity daily.

- Keep audit trail records for one year.

11. Test Security Systems:

- Regularly scan for vulnerabilities.

- Use ASV for external domain scans.

- Conduct quarterly and annual penetration tests.

12. Information Security Policy:

- Develop policies for employees and third parties.

- Require policy acknowledgment from all employees.

- Perform background checks to secure card data.

These points cover the essentials of controlling access, monitoring activities, testing security measures, and maintaining policies to protect cardholder data as per PCI DSS standards.

How to Achieve PCI Compliant: Understanding the 12 Requirements of PCI Security Standards

To achieve PCI compliance, you need to fulfill the 12 PCI-compliant requirements, which consist of 300 sub-requirements. These requirements encompass security systems, organizational processes, testing, and policies aimed at safeguarding cardholder data.

12 PCI DSS Requirements Step-by-Step

The PCI DSS provides a 12-step plan for protecting customer data and achieving compliance. It includes steps such as installing and maintaining a firewall, avoiding default settings, protecting stored cardholder data, encrypting payment data transmission, updating antivirus software, deploying secure systems and applications, restricting cardholder data access, assigning user access identification, restricting physical access to data, tracking and monitoring network access, ongoing systems, and process testing, and creating and maintaining an infosec policy. Each step involves specific actions and considerations to ensure compliance with PCI DSS standards.

5 Best Practices for PCI DSS Compliance

- Data Transparency: PCI-DSS Requirement 3 emphasizes the need to store credit card data in specific, restricted locations. Organizations should map data flows and conduct regular network scans to prevent unauthorized storage of credit card information.

- Overlaps between GDPR and PCI DSS Compliance: Adhering to PCI DSS best practices can lead to GDPR compliance. Both standards limit the storage of personal customer data, aligning with the principle of only storing necessary personal data.

- Focus on Employee Training: Employee awareness is crucial for PCI DSS compliance. Investing in training employees to understand compliance requirements and the consequences of non-compliance is essential.

- Review Cloud Architecture Regularly: Cloud environments undergo frequent changes, potentially impacting PCI compliance. Regular reviews and planning changes with security experts are necessary to identify and address risks.

- Leverage SIEM: Ongoing monitoring of security controls is a central requirement of PCI DSS. Utilizing a Security Information and Event Management (SIEM) tool can help collect logs, monitor networks, and create alerts for suspicious behavior, meeting PCI DSS rules.

Benefits of PCI DSS Compliance

PCI DSS compliance offers several key benefits:

- Reduces risk – Compliance with PCI standards shields businesses from breaches. According to a Verizon study, compliant businesses have a 50% higher chance of successfully withstanding a breach attempt.

- Boosts customer loyalty – Customers are more inclined to make purchases, particularly online, from businesses that prioritize data security and maintain PCI compliance.

- Helps avoid additional costs – Businesses may face fines from banks in the event of a breach, as well as the need to replace credit cards or compensate customers. Fewer breaches result in reduced risk of fines. If a breach occurs, businesses are elevated to PCI Level 1 and required to undergo a comprehensive, costly certification process.

- Aligns with industry standards – PCI DSS compliance ensures that businesses across the board adhere to the same rigorous security standards. By aligning with these standards, businesses ensure that their information security meets industry-wide expectations.

The future of PCI compliance

The PCI DSS launched version 4.0 in March 2022, replacing version 3.2. Organizations compliant with 3.2 have until March 2024 to become compliant with version 4.0.

How Vivant Helps You Achieve PCI DSS Compliance Requirements

Meeting PCI compliance requirements can be difficult, especially as they continue to change. However, failing to adhere to these regulations can result in costly penalties and harm to your reputation. That’s why it’s crucial to depend on comprehensive solutions such as Vivant to ensure complete compliance across your network.

Vivant simplifies compliance by overseeing and examining access to infrastructure, a crucial aspect of PCI DSS. Additionally, you can access a free set of tools and templates to quickly obtain SOC 2 certification. While SOC 2 differs from PCI DSS, there are several operational similarities. Both certifications require actions such as conducting regular vulnerability scans, implementing annual security awareness training, and conducting an annual risk assessment.