Why the Median Home Price Is Meaningless in Today & rsquo; s Market The National Association of Realtors(NAR)will release its latest Existing Home Sales(EHS )report later today. This month-to-month report supplies info on the sales volume and cost pattern for formerly owned houses. In the upcoming release, it & rsquo; ll most likely say house costs are down. This may feel a bit confusing, specifically if you & rsquo; ve been following along and seeing the blog sites saying that house rates have actually bottomed out and turned a corner. So, why will this likely say home prices are falling when so lots of other price reports state they & rsquo; re going back up? All of it depends on the approach of each report. NAR reports on the typical list prices, while some other sources use repeat list prices

. Here & rsquo; s how those approaches differ. The For Real Estate Studies at Wichita State University discusses typical costs like this: & ldquo; The typical list price determines the & lsquo; middle & rsquo; cost of homes that offered, implying that half of the homes sold for a higher price and half cost less ... For example, if more lower-priced homes have offered just recently, the median sale rate would decline (due to the fact that the & ldquo; middle & rdquo; home is now a lower-priced home), even if the worth of each specific house is rising. & rdquo; Investopedia assists define what a repeat sales method implies: & ldquo; Repeat-sales approaches determine modifications

in home rates based upon sales of the exact same home, consequently avoiding the issue of attempting to account for rate differences in houses

“with differing characteristics. & rdquo; The Challenge with the Median Sales Price Today As the quotes above state, the methods can inform various stories. That & rsquo; s why mean price information(like EHS )may say prices are down, despite the fact that the vast majority of the repeat sales reports reveal costs are appreciating “once again.” Bill McBride, Author of the Calculated Risk blog, amounts the distinction up like this: & ldquo;

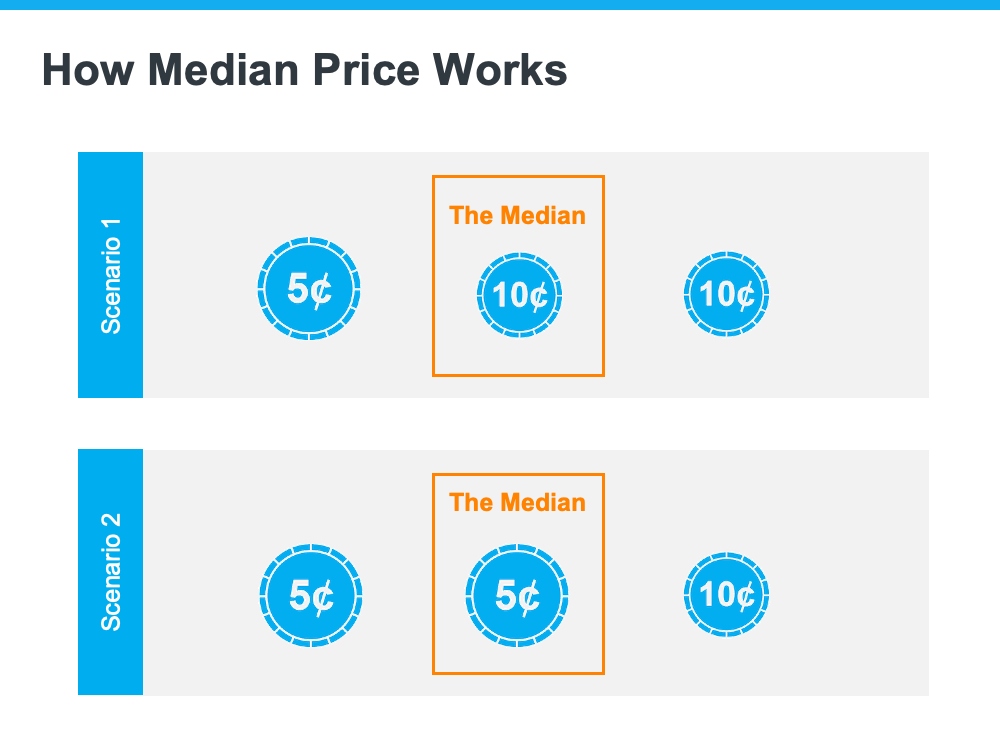

Median costs are distorted by the mix and repeat sales indexes like Case-Shiller “and FHFA are probably much better for measuring rates. & rdquo; To drive this point house, here ’ s a simple explanation of median value(see visual below ). Let & rsquo; s state you have three coins in your pocket, and

have one nickel and two dimes, the mean worth (the middle one)is 10 cents. The median worth is now five cents if you have 2 nickels and one dime. In both cases, a nickel is still worth 5 cents and a penny is still worth 10 cents. The value of each coin didn & rsquo; t modification. That & rsquo;s why utilizing the median home rate as a gauge of what & rsquo; s occurring with house worths isn & rsquo; t worthwhile right now. If they match their budgets, many purchasers look at house rates as a starting point to determine. A lot of individuals purchase houses based on the month-to-month mortgage payment they can manage, not simply the rate of the home. When mortgage rates are greater, you might need to buy a less costly home to keep your month-to-month housing cost economical.

A greater number of & lsquo; less-expensive & rsquo; homes are offering right now for this specific factor, which & rsquo; s causing

the average cost to decrease. That doesn & rsquo; t imply any single home lost value. Keep in mind the coins when you see the stories in the media that prices are falling later this week. Even if the average price changes, it doesn & rsquo; t imply house rates are falling. What it means is the mix of houses being offered is being affected by affordability and present mortgage rates. Bottom Line For a more extensive understanding of house rate patterns and reports, let & rsquo; s link. That & rsquo;

s why using the median utilizing price mean house gauge of what & rsquo; s happening with home occurring isn House worths; t worthwhile right nowBeneficial Many buyers look at home prices as a starting point to determine if they match their budgets. Many people buy houses based on the monthly home mortgage payment they can afford, not just the price of the house. Just since the median cost modifications, it doesn & rsquo; t mean house costs are falling. For a more extensive understanding of home price trends and reports, let & rsquo; s link.