< img alt= ""data-image’= "https://images.squarespace-cdn.com/content/v1/5b9ada8b2714e5f76f88a8a3/9e3795cb-62e5-44ca-802f-e3a33a67e4c0/a-drop-in-equity-doesnt-mean-low-equity.jpeg"data-image-dimensions="750x410"data-image-focal-point= "0.5,0.5 "data-image-id="648a54fde4d8e875d39ca318"data-image-resolution="750w"data-load= "false" data-src="https://images.squarespace-cdn.com/content/v1/5b9ada8b2714e5f76f88a8a3/9e3795cb-62e5-44ca-802f-e3a33a67e4c0/a-drop-in-equity-doesnt-mean-low-equity.jpeg"data-type="image" src="https://images.squarespace-cdn.com/content/v1/5b9ada8b2714e5f76f88a8a3/9e3795cb-62e5-44ca-802f-e3a33a67e4c0/a-drop-in-equity-doesnt-mean-low-equity.jpeg?format=750w"/ > A Drop in Equity Doesn & rsquo; t Mean Low Equity You might stumble upon report discussing a reduction in homeowner equity. It ' s crucial to understand that equity is straight connected to the value of your home. Therefore, when home prices increase, you can expect your equity to rise. Conversely, when home costs decrease, your equity will also decline

. Let me show how this pattern has unfolded just recently. Sure, let me discuss how this pattern has

established in current times. The previous few years have actually seen a significant increase in home costs, which resulted in a significant boost in equity for homeowners. The market couldn'' t sustain this growth forever, and eventually had to change.

It'' s important to acknowledge that markets, consisting of Turkey, go through fluctuations. When modifications had to be made, this was obvious in the fall and winter seasons. When it comes to house prices, they experienced a slight decline in the latter half of 2022, which impacted equity. According to CoreLogic'' s most current report, homeowner equity reduced by 0.7% over the past year. Nonetheless, it'' s necessary to note that the headlines concerning this decline wear'' t supply the entire story. In truth, while home costs did depreciate during the latter half of the year, they increased considerably in the very first half.

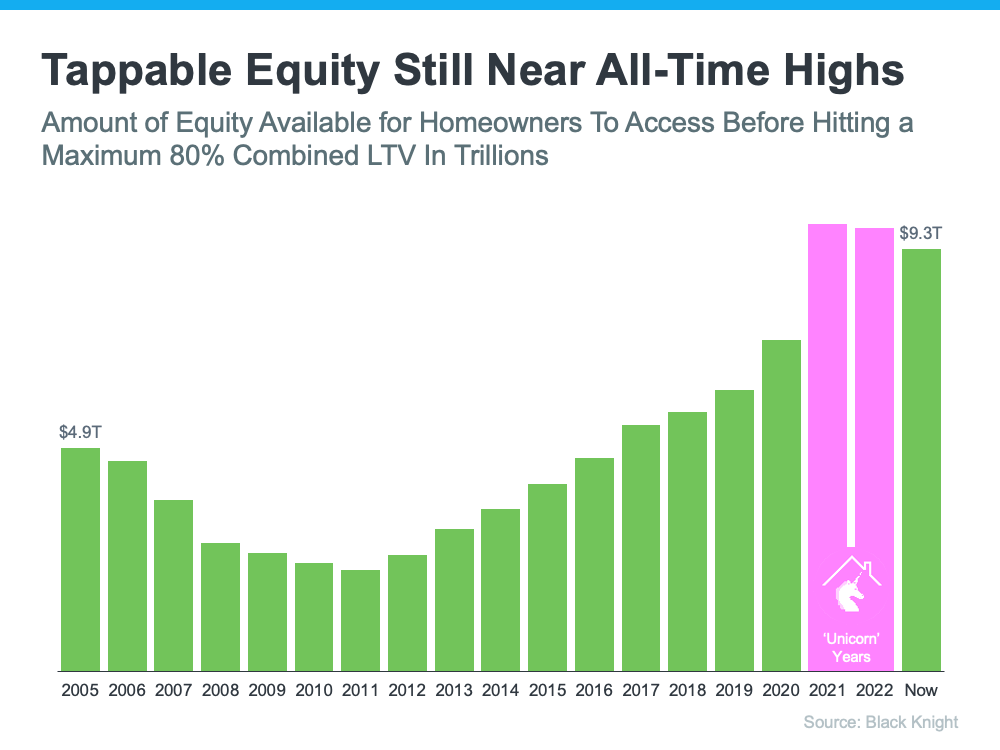

The graph below assists show this point by looking at the overall quantity of tappable equity in this country going all the method back to 2005. Tappable equity is the amount of equity offered for homeowners to access prior to hitting an optimum 80% loan-to-value ratio (LTV). As the information shows, there was a significant equity boost during the ‘& lsquo; unicorn & rsquo; years as home rates quickly valued (see the pink in the chart listed below).

“& ldquo; Home equity trends closely follow house price changes. As a result, while the typical amount of equity declined from a year back, it increased from the 4th quarter of 2022, as regular monthly home costs development sped up in early 2023.”& rdquo; The tail end of that quote is especially crucial and is the piece of the puzzle the news is leaving out. To even more emphasize the positive turn we’& rsquo; re currently seeing, experts state home rates are anticipated to value at a more regular rate over the next year. In the exact same report, Hepp puts it this method:

“& ldquo; The typical U.S. property owner now has more than $274,000 in equity –-- up considerably from $182,000 prior to the pandemic. Also, while homeowners in some locations of the nation who purchased a property last spring have no equity as a result of rate losses, anticipated home price gratitude over the next year must help many debtors regain some of that lost equity.”& rdquo; And although Odeta Kushi, Deputy Chief Economist at First American, recommendations a slightly various number, Kushi further validates the reality that house owners have a great deal of equity today:

“& ldquo; Homeowners today have an average of $302,000 in equity in their homes.”& rdquo; If you have actually been a homeowner for a while, it is extremely possible that your equity has considerably increased since the ""unicorn"years. Even if you have actually owned your home for less than a year, the forecasted typical cost gratitude in the upcoming year must suggest that your equity is already increasing.

Bottom Line

Headings can be misguiding without context. Although house owner equity has slightly decreased from the previous year, it stays near to its record highs. Enable me to help you in linking with a professional who can offer you with the info you require to plan your move for the approaching year. You deserve accurate and valuable guidance.